Secured financing

Guaranteed and secure assets

SAGESS’ system of securing the financing for strategic oil reserves contributes to its balance sheet. SAGESS assets primarily consist of oil products bought and maintained at the disposal of the State. These assets are booked at their acquisition value (dedicated tax code provision), and are not exposed to price fluctuations in the oil market.

By year-end 2018, they amounted to 4.413 million €, that is 94.6% of all assets. The fair market value of SAGESS strategic stocks is close to 6.083 million € at this same date.

In the case that SAGESS, following a government request, had to sell its strategic stocks on the market, a tax law provides SAGESS with the guarantee that it would at least recover its stocks acquisition price, protecting it from any risk of loss (the CPSSP would compensate SAGESS if the selling price were lower than acquisition cost). SAGESS is then protected against price fluctuations.

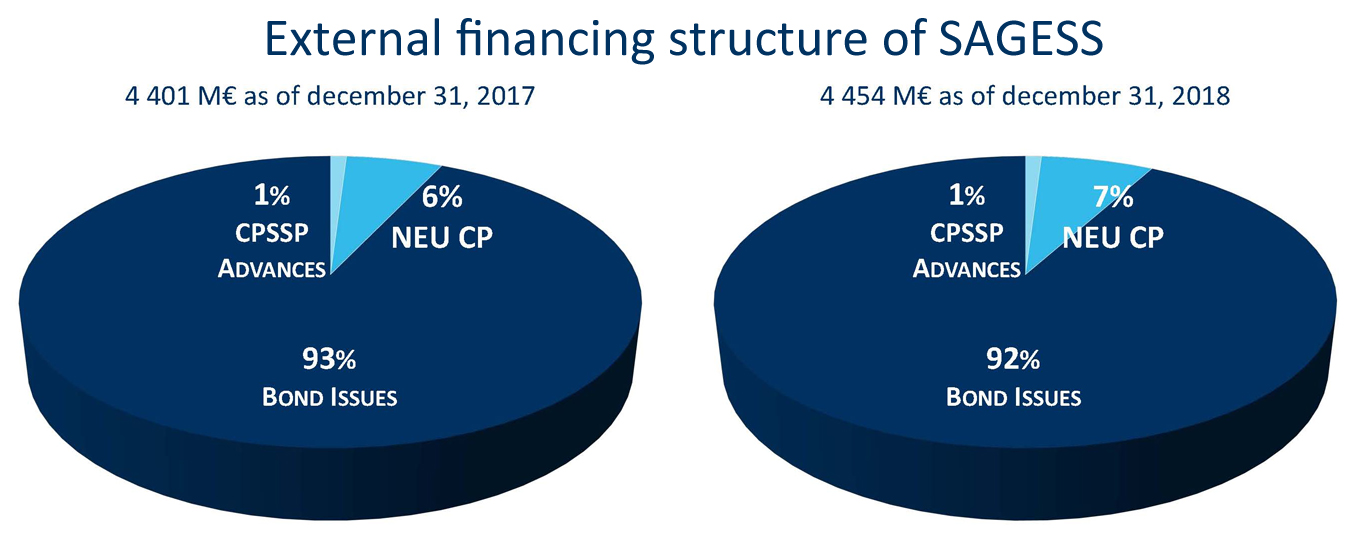

CPSSP, bonds, commercial papers: diversified financing

88% of SAGESS’ assets are financed by bonds. To be financially stable, SAGESS diversifies its funding sources. By year-end 2018, SAGESS main financing sources are the CPSSP (1%), NEU CP (7%) and bonds (92%). If long term bonds are attached to fixed rates and mainly “swaped” at fluctuating rates, the NEU CP have a short-term maturity (1 to 3 months). With SAGESS’ excellent rating, NEU CP represent a funding source with lower costs for SAGESS and a financial process particularly appreciated by investors.