Full cost coverage

All SAGESS operating costs covered by the CPSSP

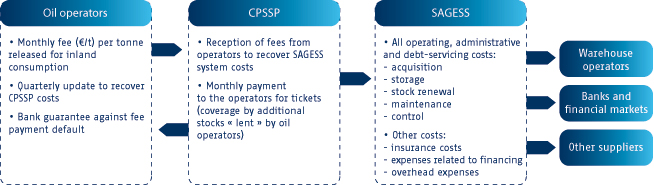

As per the CPSSP / SAGESS agreement, approved by Ministerial decree, SAGESS recovers all operating, financing and exceptional costs from the CPSSP, guaranteeing a structurally balanced statement. The CPSSP receives monthly fees from oil operators, calculated to cover its own and SAGESS’ costs, balancing the oil reserves accounting system. In addition, the CPSSP is financially guaranteed up to three months of fees in case of default by oil operators.

SAGESS costs

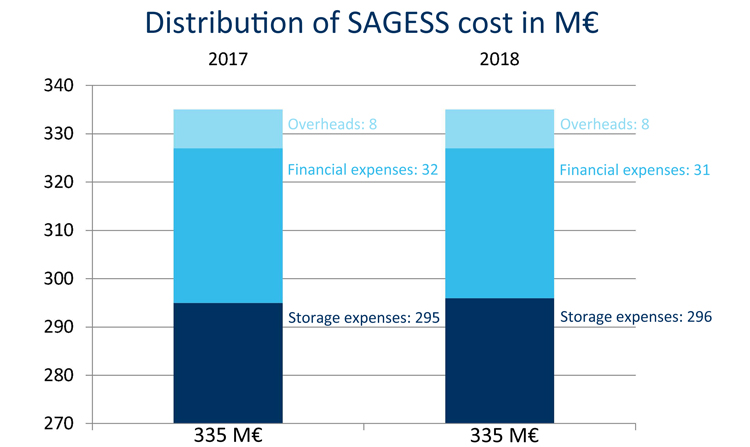

SAGESS costs are divided into three major areas : product storage and stocks maintenance costs (renting facilities, storage at third party locations maintenance, stock renewal, product upgrades, control and insurance costs), expenses related to financing (bonds, NEU CP and bank loan) and overhead expenses.

Dedicated tax scheme

On a theoritical basis, SAGESS manages a break-even operation, but exceptionnaly can make a profit when SAGESS sells its strategic stocks and makes a profit as a consequence. SAGESS has a preferential tax scheme exempting it from income taxes. A tax article in the General Tax Code (1655 quater) exempts SAGESS from corporate taxes under condition, the taxation is applicable to shareholders on the dividends distribution.

As regards VAT, SAGESS is not subject to VAT for all storage-related operations and recovers the VAT when applicable (general tax rules).